-

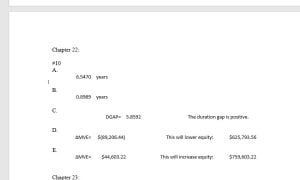

Chapter 22 Problem 10 – Use the following balance sheet information to answer this question……

- What^is the average duration of all the assets?

- What.is the average duration of all the liabilities?

- What-is the FI’s leverage-adjusted duration gap? What is the FI’s interest rate risk exposure

- If the entire yield curve shifted upward 0.5 percent (i.e., ΔR/(1 + R) = .0050), what is the impact on the FI’s market value of equity?

If the entire yield curve shifted downward 0.25 percent (i.e., ΔR/(1 + R) = −.0025), what is the impact on the FI’s market value of equity?

Chapter.23 Problem 4 – The duration of the assets is six years and the duration of the liabilities is four years. The.bank is expecting interest rates to fall from 10 percent to 9 percent over the next year.

- What,is the duration gap for Hedge Row Bank?

- What is the expected change in net worth for Hedge Row Bank if the forecast is accurate?

- What-will be the effect on net worth if interest rates increase 100 basis points?

- If the existing interest rate on the liabilities is 6 percent, what will be the effect on net worth of a 1 percent increase in interest rates?

Chapter 23 Problem 15 – An insurance company owns $50 million of floating-rate bonds yielding LIBOR plus 1 percent. These loans are financed by $50 million of fixed-rate guaranteed investment contracts (GICs) costing 10 percent. A finance company has $50 million of auto loans with a fixed rate of 14 percent. They are financed by $50 million of debt with a variable rate of LIBOR plus 4 percent. If the finance company is going to be the swap buyer and the insurance company the swap seller, what is an example of a feasible swap?

Chapter 24 Problem 8 – Consider a GNMA mortgage pool with principal of $20 million. The maturity is 30 years with a monthly mortgage payment of 10 percent per year. Assume no prepayments.

- What is the monthly mortgage payment (100 percent amortizing) on the pool of mortgages?

- If the GNMA insurance fee is 6 basis points and the servicing fee is 44 basis points, what is the yield on the GNMA pass-through?

- What is the monthly payment on the GNMA in part (b)?

- Calculate the first monthly servicing fee paid to the originating Fis

Calculate the first monthly insurance fee paid to GNMA.

SOLUTION

……please click the icon below to purchase the solution at $10