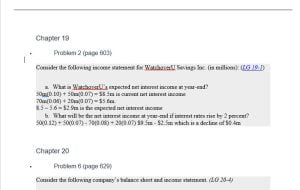

- Chapter 19 Problem 2 – Consider the following income statement for WatchoverU Savings Inc. (in millions):

- What is WatchoverU’s expected net interest income at year-end?

- What will be the net interest income at year-end if interest rates rise by 2 percent?

Chapter 20 Problem 10 – The following is ABC, Inc.’s, balance sheet (in thousands): ………

- Calculate Altman’s Z-score for ABC, Inc., if ABC has a 50 percent dividend payout ratio and the market value of equity is equal to its book value. Recall the following:

- Should you approve ABC Inc.’s application to your bank for $500,000 for a capital expansion loan?

- If ABC’s sales were $450,000, taxes were $16,000, and the market value of equity fell to one-quarter of its book value (assume cost of goods sold and interest are unchanged), how would that change ABC’s income statement? If ABC’s tax liability could be used to offset tax liabilities incurred by the other divisions of the firm, would your credit decision change?

- What are some of the shortcomings of using a discriminant function model to evaluate credit risk?

Chapter 21 Problem 6 – A DI has the following assets in its portfolio: $20 million in cash reserves with the Fed, $20 million in T-bills, and $50 million in mortgage loans. If it needs to dispose of its assets at short notice, it will receive only 99 percent of the fair market value of the T-bills and 90 percent of the fair market value of its mortgage loans…………….Calculate the one-month liquidity index using the above information.

SOLUTION

……please click the icon below to purchase the solution at $10