FIN 564 Week 1 Homework Assignment FIN 564 Week 2 Homework Assignment FIN 564 Week 3 Homework Assignment FIN 564 Week 4 Homework Assignment FIN 564 Week 5 Homework Assignment FIN 564 Week 6 Homework Assignment FIN 564 Week 7 Homework Assignment...............please click the icon below to purchase week 1 - 7 assignments at $68

Read More

Instructions This paper is a comprehensive analysis of the financial standing of Fifth Third Bank. In the first part we will review Fifth Third Bank’s profile, mission statement and future direction. Later we will take a look at Fifth Third Bank’s financial statements and review some ratios from the past 5 years. For this paper Fifth Third Bank will be compared to PNC Bank one of their competitors in the Chicago land area. The analysis will conclude with my forecast of Fifth Third Banks futu...

Read More

Chapter 9 Problem 5 – Bankone issued $200 million worth of one-year CD liabilities in Brazilian reals at a rate of 6.50 percent. The exchange rate of U.S. dollars for Brazillian reals at the time of the transaction was $1.00/Br 1.Is Bankone exposed to an appreciation or depreciation of the U.S. dollar relative to the Brazillian real?

What will be the percentage cost to Bankone on this CD if the dollar depreciates relative to the Brazillian real such that the exchange rate of U.S. dollar...

Read More

Chapter 15 Problem 6 – An insurance company’s projected loss ratio is 77.5 percent, and its loss adjustment expense ratio is 12.9 percent. It estimates that commission payments and dividends to policyholders will add another 16 percent. What is the minimum yield on investments required in order to maintain a positive operating ratio?Chapter 15 Problem 7 – An insurance company collected $3.6 million in premiums and disbursed $1.96 million in losses. Loss adjustment expenses amounted to 6.6 pe...

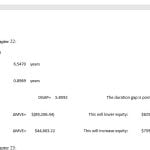

Read MoreChapter 22 Problem 10 – Use the following balance sheet information to answer this question……What^is the average duration of all the assets?

What.is the average duration of all the liabilities?

What-is the FI’s leverage-adjusted duration gap? What is the FI’s interest rate risk exposure

If the entire yield curve shifted upward 0.5 percent (i.e., ΔR/(1 + R) = .0050), what is the impact on the FI’s market value of equity?If the entire yield curve shifted downward 0.2...

Read More

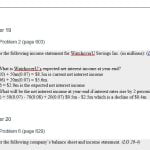

Chapter 19 Problem 2 – Consider the following income statement for WatchoverU Savings Inc. (in millions):What is WatchoverU’s expected net interest income at year-end?

What will be the net interest income at year-end if interest rates rise by 2 percent?Chapter 20 Problem 10 – The following is ABC, Inc.’s, balance sheet (in thousands): ………Calculate Altman’s Z-score for ABC, Inc., if ABC has a 50 percent dividend payout ratio and the market value of equity is equal to its bo...

Read More

Chapter 12 Problem 6:The financial statements for THE Bank are shown below:………

Calculate.THE Bank’s earning assets.

Calculate-THE Bank’s ROA

Calculate THE Bank’s total operating income

Calculate THE Bank’s spreadChapter 12 Problem 8 – Megalopolis Bank has the following balance sheet and income statement….Return on equity

Return on assets

Asset utilization

Equity multiplier

Profit margin

Interest expense ratio

Provision for loan loss ratio...

Read More

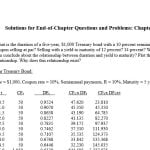

Problems 6 – What is the duration of a five-year, $1,000 Treasury bond with a 10 percent semiannual coupon selling at par? Selling with a yield to maturity of 12 percent? 14 percent? What can you conclude about the relationship between duration and yield to maturity? Plot the relationship. Why does this relationship existProblems 10 – Calculate the yield to maturity on the following bonds.Problems 22 – A stock you are evaluating just paid an annual dividend of $2.50. Dividends have grown...

Read More

Problem 1 – A particular security’s equilibrium rate of return is 8 percent. For all securities, the inflation risk premium is 1.75 percent and the real interest rate is 3.5 percent. The security’s liquidity risk premium is .25 percent and maturity risk premium is .85 percent. The security has no special covenants. Calculate the security’s default risk premium. (LG 2-6)Problem 2 – You are considering an investment in 30-year bonds issued by Moore Corporation. The bonds have no special covena...

Read More