Course

ACCT 212 Financial Accounting

Week 7 Homework Assignment

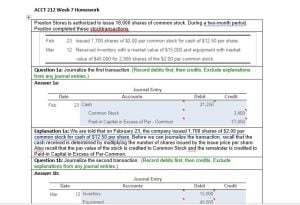

1. Question: Preston Stores is authorized to issue 18,000 shares of common stock. During a two-month period, Preston completed these stock transactions:

- Journalize the first transaction. (Record debits first, then credits. Exclude explanations from any journal)

- Journalize the second transaction. (Record debits first, then credits. Exclude explanations from any journal)

- The company’s Retained Earnings account has a balance of $44,000.Prepare the stockholders’ equity section of Preston’s balance sheet for the transactions. Begin by selecting the appropriate accounts for the balance sheet.

- Calculate the total par value of all common stock issued during the period using the information given.(Enter the accounts in the proper order for the stock holders’ equity section of the balance sheet.)

- Determine the total additional paid-in capital attributable to the common stock transactions during the period using the T-account

- The company’s Retained Earnings account has a balance of $44,000.Complete the statement by calculating total stockholders’ equity.

2. Question: At December 31, 2018, PioneerCorporation reported the stockholders’ equity accounts shown here(with dollar amounts in millions, except per-share amounts).

- Journalize Pioneer’s transactions in parts b, c, d, and e

- Prepare the entry for the issuance of the common stock using the amounts calculated in the preceding steps. Issuance of 12 million shares of common stock for $13 per share.(Enter amounts in millions as provided to you in the problem statement. Record debits first, then credits. Exclude explanations from any journal)

- Prepare the entry to record the purchase of 9 million shares of treasury stock for $108

- Prepare the entry to record the sale of 4 million of the treasury shares purchased in part c for $28

- On the declaration date, the board of directors announces the dividend. Declaration of the dividend creates a liability for the corporation. Journalize the declaration and payment of cash dividends of $37 million

- What was the overall effect of these transactions (parts a through e) on Pioneer’s stockholders’ equity?

3. Question: Data from the financial statements of Modern Candle Company included the following:

- … profit(Round your answer to one decimal place, X.X%.)

- Calculate the ratio for the asset turnover ratio.

- Calculate the ratio for the Leverage ratio.(Round your answer to one decimal place, X.X.)

- Calculate the ratio for the Return on assets(ROA).(Round your answer to one decimal place,X%.)

- Calculate the ratio for the Return on equity(ROE).(Round your answer to one decimal place,X%.)

- Which ishigher, ROA or ROE? Does this make sense for stockholders? Why or why not?

4. Question: Identify each of Vander pool’s transactions as operating (O), investing (I), financing (F), noncash investing and financing (NIF), or a transaction that is not reported on the statement of cash flows (N). Indicate whether each item increases (+) or decreases (−) The indirect method is used for operating cash flows.

5. Question: Prepare Stoughton’s statement of cash flows for the year ended December 31, 2018, using the indirect method.

- Complete the cash flows from investing activities. (Use parentheses or a minus sign for numbers to be subtracted and for a net decrease in)

- Complete the cash flows from financing activities. (Use parentheses or a minus sign for numbers to be subtracted and for a net decrease in)

- Complete the statement of cash flows.

SOLUTION

…….please click the icon below to purchase the solution at $15